Current Active Drilling Rigs – April 2024

April 22, 2024

Over the past month, oil prices have trended up. Prices closed at $79.97 on March 1st. On March 12th, prices hit a low of $77.56. From there, prices have risen to a high of $82.73 on March 19th. Prices closed at $80.63 on March 22nd.

The March 22nd Baker Hughes rig count report shows a continuing decline in the active rig count. Baker Hughes reports 624 active drilling rigs in the US. One month ago, the total active rig count was 626. One year ago, the total active rig count was 758.

The oil rig count is currently 509 rigs, compared to 503 one month ago and 593 one year ago. The gas rig count is 112, compared to 120 one month ago and 162 last March.

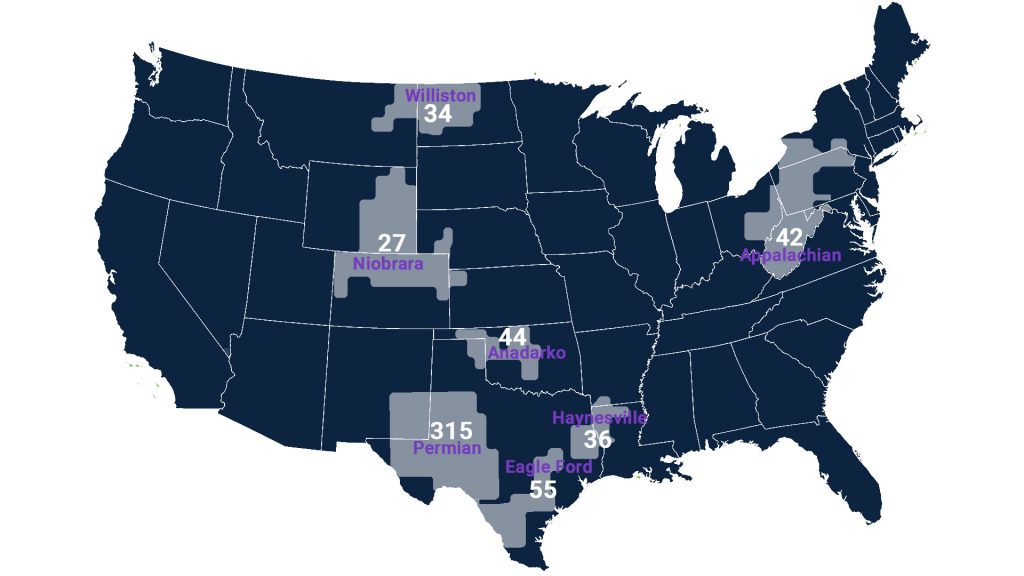

April 2024 Rig Count by Shale*

In the major plays, the Permian Basin rig count is at 315 rigs, up 1 from the February count.

In east Texas, the Eagle Ford has 55 active rigs, 3 up from February.

The Haynesville rig count is 36 rigs, 7 less than last month.

The Anadarko rig count is 44 rigs, the same as in February.

The active rig count in the Niobrara is 27 rigs, the same as last month.

The Williston Basin rig count is 34 rigs, the same as the February count.

The Appalachian has 42 active rigs, one more than last month.

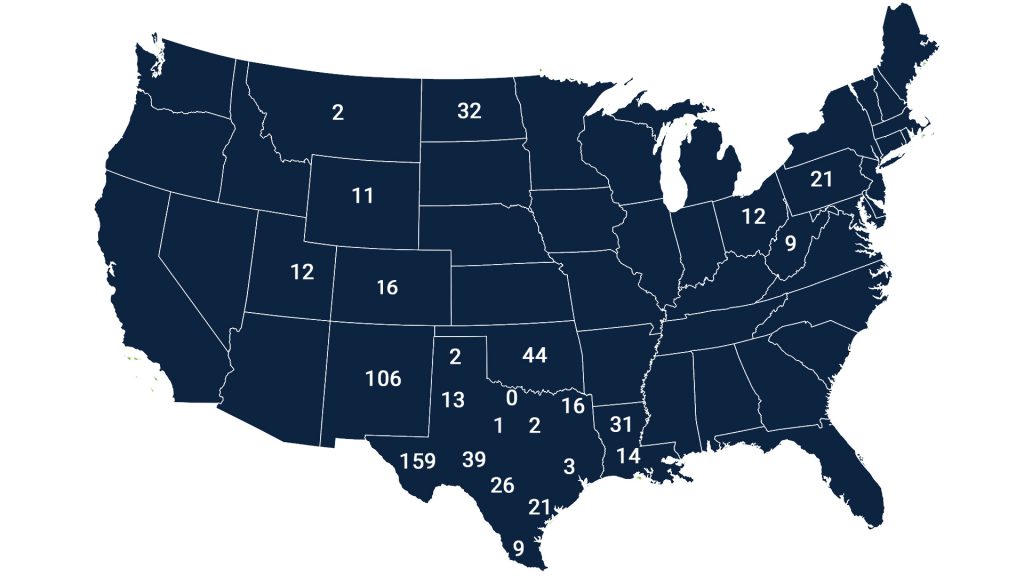

April 2024 Rig Count by State*

*Data from April 2024, Baker Hughes Report.

| Bakken Region Total: 34 Montana: 2 North Dakota: 32 |

Rocky Mountain Total: 145 Colorado: 16 New Mexico: 106 Utah: 12 Wyoming: 11 |

Central Plains Total: 45 Oklahoma: 44 Kansas: 1 Arkansas: 0 |

| Gulf States Total: 44 Alabama: 0 Louisiana North: 26 Louisiana South (land & offshore): 18 Mississippi: 0 |

Texas Total: 291 Texas RRC District 1: 26 District 2: 21 District 3: 3 District 4: 9 District 5: 2 District 6: 16 District 7B: 1 District 7C: 39 District 8: 159 District 8A: 13 District 9: 0 District 10: 2 |

Appalachian Total: 42 Ohio: 12 Pennsylvania: 21 West Virginia: 9 |

For more detailed news and information on the oil industry, please visit our oilfield news and information page.

Want to Receive Rig Counts & Industry News in Your Inbox? Fill Out This Form. We’ll Keep You Updated.

Scale Funding Factoring Services

Scale Funding is a leading provider of accounts receivable factoring for oilfield service companies. Factoring is a type of financing many companies use to get immediate cash for their open receivables.

Benefits of Accounts Receivable Factoring

- Immediate Cash Availability

- No Long-Term Contracts

- Based on Customer’s Credit, Not Yours

- Customized Factoring Programs to Fit Your Needs

If your oilfield services company is being held back by slow cash flow, or if you need money to meet those daily expenses, call Scale Funding at 800-707-4845, or contact us via the web.