How Does Factoring Work?

February 14, 2018

Invoice factoring, also known as accounts receivable factoring, is a debt-free financing solution used by companies to take control of their finances. Instead of waiting on customer payment, invoice factoring pays you right away on your open invoices. People often wonder, “how does factoring work?” Although the process is fairly simple, we find many still want a brief explanation of how invoice factoring works and how to get started.

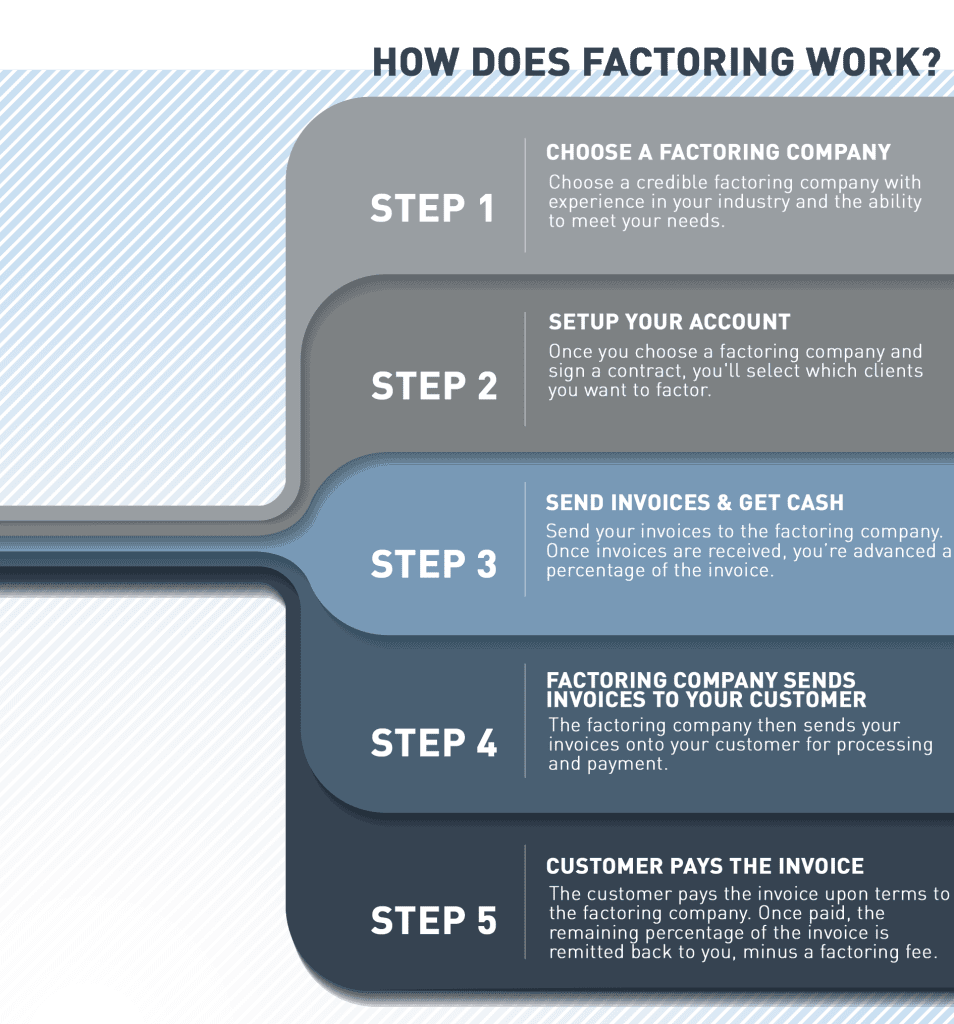

How Does Factoring Work?

Step 1: Choose A Factoring Company

The first step to start invoice factoring is choosing a credible factoring company. There are many factoring companies to choose from, but you want to be sure to select one that is right for your business needs.

Be sure to think about these items when selecting a factoring company.

- How long has the factoring company been in business?

- Is it recourse or non-recourse factoring?

- Have they worked with your industry before?

- What is the length of the contract?

- What are the minimum and the maximum amount of invoices you can factor per month?

- Are there any hidden fees?

- Do they offer back-office support such as accounts receivable management and collections?

Step 2: Setup Your Account

Once you choose a factoring company and sign a contract, you’ll select which clients you want to factor. The factoring company will conduct due diligence on the clients you wish to factor. From there, the factoring company sets a maximum dollar amount on the invoices you wish to factor.

Step 3: Send Invoices & Get Cash

Send your invoices to the factoring company. When the factoring company receives the invoices, you’re advanced a percentage of the invoice directly into your bank account. – If you choose Scale Funding as your factoring company, we advance you on your invoices the day that we receive them.

Step 4: Factoring Company Sends Invoices To Your Customer

The factoring company then sends your invoices onto your customer for processing and payment.

Step 5: Customer Pays the Invoice

Your customer sends payment at their agreed upon terms to the factoring company. Once the factoring company receives payment, the remaining percentage of the invoice is remitted back to you, minus a factoring fee.

Why Do Companies Use Invoice Factoring?

Companies in a variety of situations use invoice factoring. Ultimately, everyone’s motive with invoice factoring is to improve cash flow. Whether you just can’t wait for customer payment, or you were turned down by a bank, invoice factoring can help you take control of your finances so you have the cash at hand to operate and grow.

Is Invoice Factoring Right For You?

The answer to the question, “how does factoring work?” is simple. If you could use cash for your company sooner than your invoices are being paid, invoice factoring can help.

Scale Funding is proud to be North American’s number-one factoring company. For more than 20 years, we’ve helped companies operate and grow. If you want to learn more about our services or want to get started today, give us a call at (800) 707-4845 or contact us via the web for a free, no-obligation factoring consultation and quote.