Recourse Factoring Versus Non-Recourse Factoring

April 4, 2018

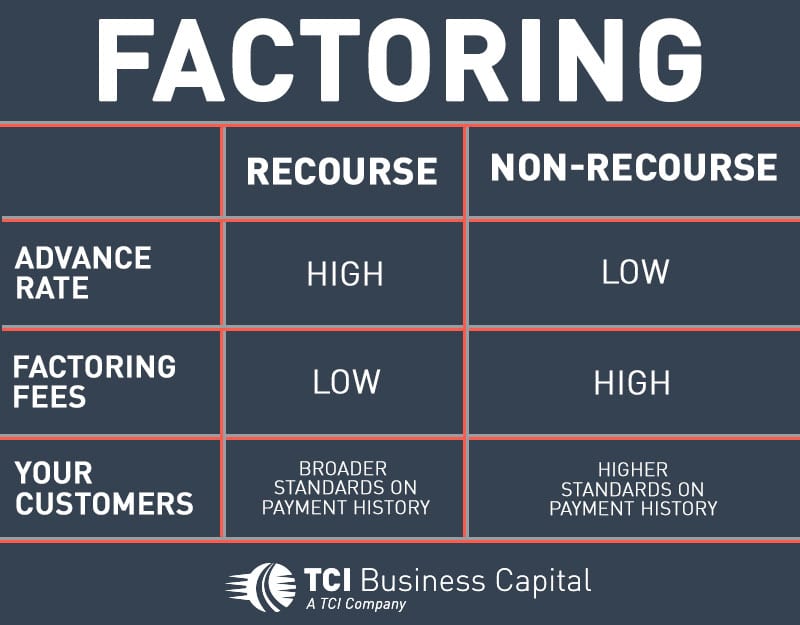

One of the common questions people have about invoice factoring is, “what is the difference between recourse factoring versus non-recourse factoring?” Both types of factoring are beneficial to companies needing consistent, reliable cash flow. However, understanding the characteristics of each will help determine which one is the right choice for your company.

What is Recourse Factoring?

Recourse factoring is the standard factoring product offered by most factoring companies in North America. Factoring clients that have a recourse factoring agreement are still ultimately liable for the invoice. With recourse factoring, any unpaid invoice that is uncollectible or in dispute can be “recoursed” or sold back to the factoring client.

When an invoice is recoursed by the factoring company, the factoring fees are calculated up to the date of the recourse. Then the advance amount, plus the factoring fees are debited from the factoring client’s collected reserves account.

Recourse factoring is popular because factoring clients are often providing work or services to a large number of different customers, with a variety of payment histories. The factoring company can offer high advance rates and lower factoring fees when purchasing the invoices. This also minimizes their risk when extending credit on debtors with less-than-stellar payment histories.

What is Non-Recourse Factoring?

Non-recourse factoring is not as widely offered or used in North America. With non-recourse factoring, when the factoring company purchases the invoice, it assumes full liability on the invoice. However, factoring companies that offer non-recourse factoring services often stipulate in the contract that the non-recourse only applies in situations where the debtor files bankruptcy. You should review your factoring agreement for this provision.

The risk for a factoring company is much more significant with non-resource factoring. The risk results in higher factoring fees and lower advance rates. The factoring rates can be as much as 1–2 percent higher compared to a recourse factoring agreement.

The main difference between recourse factoring versus non-recourse factoring comes with the factoring client’s customers. With non-recourse factoring, these customers must have an extensive history of prompt, on-time invoice payments for the factoring company to purchase the invoice. If there is any question about the customer’s ability or willingness to pay the invoice, it will not be purchased.

Choosing a Factoring Company

When shopping for an invoice factoring company, remember most will offer a recourse factoring service. In most situations, recourse factoring will be the best type of factoring program available. If you believe non-recourse factoring is right for your company, you may need to do further research to find a factoring company which offers this service.

About Scale Funding

Since 1994, Scale Funding has provided factoring to successful and growing businesses across the United States and Canada. Scale Funding offers same-day advances and competitive factoring rates. Scale Funding has more than 20 years of experience serving companies in a variety of situations. For more information about invoice factoring, please submit the contact us form, or call (800) 707-4845.